US equity futures fell on Friday as some investors became increasingly anxious about the president-elect

$ 1.9 trillion Covid-19 Relief Plan It can lead to higher taxes.

S&P 500 futures fell 0.3%, indicating that the benchmark index may be Rejected for the second day. The contracts related to the Nasdaq 100 index are down less than 0.1% and the contracts related to the Dow Jones industrial average are down 0.3%.

The S&P 500 is on track to end the week lower, erasing some of the gains made in early January when the measure rose to a record high. Markets have long welcomed Democrats’ plans to expand government spending and boost economic recovery. But the scale of Biden’s plans, shown late Thursday, helped verify some of that optimism.

“The volume was surprisingly clear to the upside,” said Wei Li, head of investment strategy at the company.

Exchange-traded funds and index investments for Europe, the Middle East and Africa. With a majority of the Senate, [taxes] It could come in the medium term and that is something the market should evaluate as well. ”

Investors hope the extra spending will help guide the US economy during a winter that has seen soaring Covid-19 infection rates and deteriorating economic data. Figures released on Thursday showed that The number of workers applying for unemployment benefits It recorded its biggest weekly gain since the pandemic spread last March.

“When you see the data this bad, you have to ask if the prevailing expectation – for a cyclical recovery – is going to shake,” Ms. Lee said.

Data on US retail sales for December, scheduled for 8:30 am ET, will provide more information on the strength of consumer spending and the severity of the broader economic slowdown at the end of the year.

Investors will also get an indication of how confident American households are when the University of Michigan releases preliminary January numbers for its Consumer Confidence Index at 10am ET. Consumer spending accounts for more than two-thirds of US economic activity.

In the bond markets, the yield on the 10-year Treasury fell to 1.109% from 1.128% on Thursday. Yields decrease when bond prices rise.

Despite the downturn days in the markets, investors are still anticipating that additional financial stimulus will support the rally in stocks this year.

„Ultimately, you can’t expect stocks to go up every day in a straight line,” said Mike Bell, global market strategist at JP Morgan Asset Management. „The numbers are really unbelievable and I think it will all lead to increased growth once vaccines are introduced.”

Ahead of the opening bell, major US banks including JPMorgan Chase, Citigroup and Wells Fargo are due to announce their quarterly earnings starting at 6:45 AM ET. There will likely be a lot of focus Bank expectations for 2021.

Overseas, the Stoxx Europe 600 is down 0.3%.

Asian trading ended mixed. The Chinese Shanghai Composite was largely flat, while the Hang Seng in Hong Kong was up 0.3% and the Kospi in South Korea was down 2%.

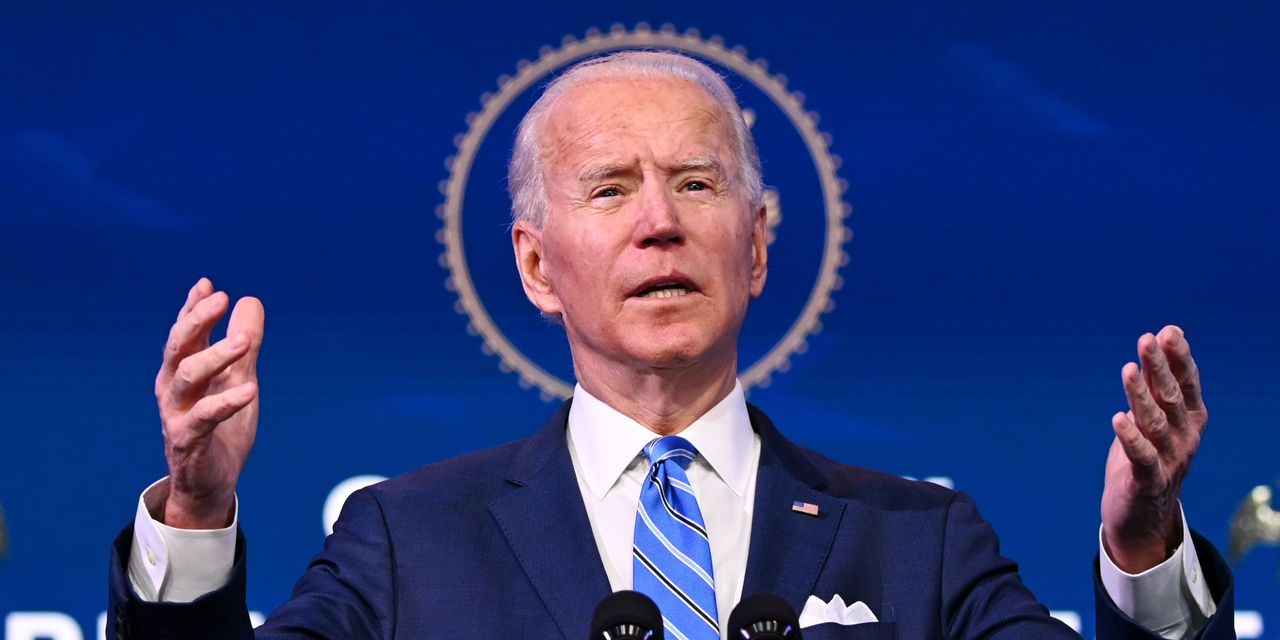

President-elect Joe Biden has proposed pumping $ 1.9 trillion into the US economy when he takes office next week.

Photo:

Jim Watson / AFP / Getty Images

-that Artificial intelligence tool It was used in creating this article.

Write to Caitlin Ostroff at [email protected]

Copyright © 2020 Dow Jones & Company, Inc. all rights are save. 87990cbe856818d5eddac44c7b1cdeb8

„Analitikas. Kūrėjas. Zombių fanatikas. Aistringas kelionių narkomanas. Popkultūros ekspertas. Alkoholio gerbėjas”.